Your credit score is one of the most important financial metrics that lenders, landlords, and even employers may use to evaluate your financial responsibility. It can influence everything from loan approvals to insurance rates, and even the terms on which you can borrow money. Whether you’re looking to buy a house, take out a car loan, or simply secure a credit card, having a good credit score can open doors to better financial opportunities.

In this article, we’ll dive into what credit scores are, how they are calculated, and most importantly, how you can build and improve yours to ensure a strong financial future.

What Is a Credit Score?

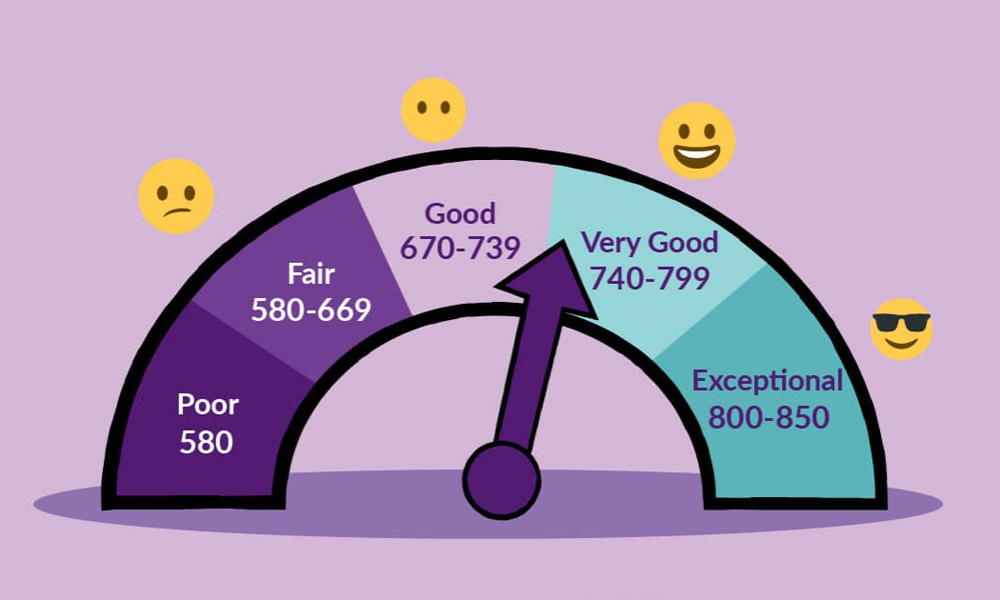

A credit score is a numerical representation of your creditworthiness, which is an indication of how likely you are to repay borrowed money on time. It’s used by lenders and other financial institutions to assess the risk of lending money to you. Credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness.

There are several types of credit scores, but the most commonly used are the FICO® Score and VantageScore. Both scoring models use similar factors to calculate your score, but they may weigh those factors slightly differently.

Factors That Impact Your Credit Score

Credit scores are calculated based on several key factors that reflect your borrowing and repayment behavior. Each factor has a different weight in determining your overall score. Understanding these factors can help you focus on areas where you can improve.

1. Payment History (35%)

Your payment history is the most significant factor in your credit score. This includes whether you’ve paid your bills on time, such as credit cards, loans, and even utilities. Missed or late payments, bankruptcies, and defaults can negatively impact your credit score. Conversely, a long history of on-time payments will help boost your score.

How to Improve It:

To build a strong payment history, always pay your bills on time. If you’re having trouble remembering due dates, consider setting up automatic payments or using reminder apps.

2. Amounts Owed (30%)

This factor considers how much debt you have in relation to your available credit. It’s also known as your credit utilization ratio. For example, if you have a $10,000 credit limit and a $5,000 balance, your credit utilization rate is 50%. A higher utilization ratio can negatively affect your credit score.

How to Improve It:

Try to keep your credit utilization rate below 30%. This means that if you have a $10,000 credit limit, aim to carry no more than $3,000 in outstanding balances. Paying down existing balances will lower your credit utilization and improve your score.

3. Length of Credit History (15%)

The length of time you’ve been using credit also plays a role in your credit score. A longer credit history demonstrates to lenders that you are experienced in managing credit responsibly. This factor includes the average age of your accounts and the age of your oldest account.

How to Improve It:

The best way to build your credit history is to keep your accounts open and avoid closing old credit cards. The longer your accounts are open, the more positive impact they will have on your score.

4. Types of Credit Used (10%)

Credit scoring models also consider the mix of credit accounts you have. This includes credit cards, installment loans (such as auto loans or mortgages), and revolving credit (such as lines of credit). Having a diverse mix of credit can improve your score, as it shows you can manage different types of credit responsibly.

How to Improve It:

If you only have one type of credit (e.g., only credit cards), consider adding a different type, such as an auto loan or mortgage, to your credit profile. However, only take on new debt if you can manage it responsibly.

5. New Credit (10%)

When you apply for new credit, a hard inquiry (also known as a “hard pull”) is made on your credit report. Multiple hard inquiries in a short period can indicate to lenders that you may be a higher risk. This can lower your credit score temporarily.

How to Improve It:

Avoid applying for new credit too frequently. Instead, only apply for credit when it’s absolutely necessary, and try to space out applications over time.

How to Build Your Credit Score

If you’re just starting to build your credit or if you have a low credit score, there are several strategies you can use to improve your score over time.

1. Apply for a Credit Card

If you don’t have any credit accounts, applying for a credit card is a good first step. A secured credit card, which requires a deposit as collateral, is a great option for people with no credit history. Using this card responsibly will help establish your credit.

2. Become an Authorized User

If you have a family member or close friend with good credit, ask if you can be added as an authorized user on their credit card account. This allows you to benefit from their good credit history without being responsible for the payments.

3. Pay Bills On Time

As mentioned earlier, payment history has the biggest impact on your credit score. Paying bills on time, including credit cards, loans, and even rent, is crucial to building a positive credit history. Set up automatic payments or use reminders to ensure you never miss a due date.

4. Keep Credit Utilization Low

Try to keep your credit utilization ratio below 30%. This demonstrates to creditors that you’re responsible with your credit usage and that you don’t rely too heavily on borrowed money.

5. Monitor Your Credit Report

Regularly checking your credit report allows you to spot any errors or inaccuracies that could be negatively affecting your credit score. You can request a free credit report once a year from each of the three major credit bureaus—Equifax, Experian, and TransUnion—at AnnualCreditReport.com.

How to Improve Your Credit Score

If you already have a credit score but want to improve it, consider the following strategies:

1. Pay Down Existing Debt

The quicker you pay down high-interest debt, the sooner your credit score will improve. Start with the debt that has the highest interest rates first, such as credit cards, and gradually work your way down. Once your debt is lower, your credit utilization ratio will decrease, positively affecting your score.

2. Negotiate with Creditors

If you have a history of late payments or collections, you may be able to negotiate with your creditors to have negative marks removed from your credit report. Contact your creditors to discuss the possibility of “pay-for-delete” agreements or other compromises.

3. Use a Credit Builder Loan

Some banks and credit unions offer credit builder loans, which are designed to help individuals build credit. These loans are typically small amounts, and the money is held in a savings account while you make payments. Once you’ve paid off the loan, the lender reports your positive payment history to the credit bureaus.

4. Avoid Unnecessary Credit Applications

While it might be tempting to apply for credit cards or loans to build credit, applying for too many accounts can hurt your score due to the hard inquiries associated with each application. Only apply for credit when you really need it.

Conclusion

Building and improving your credit score takes time, patience, and responsible financial behavior. By paying your bills on time, keeping your credit utilization low, and managing a mix of credit types, you can improve your credit score and enjoy better financial opportunities. Whether you’re starting from scratch or working to improve an existing score, the key is consistency and discipline.

Remember, your credit score isn’t just a number; it’s a reflection of your ability to manage credit responsibly. With the right strategies and mindset, you can build a solid foundation for your financial future.